We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more.

Purchase of furniture with payment in installments? Check why it's worth it

In our first post, we discussed 3 ways to leasing furniture . The previous text was theoretical, but we all know what theory is without practice.

Therefore, we decided to slightly expand the subject of purchasing office equipment with another text. It will focus only on practical aspects, it will show the benefits to the entrepreneur who decides to use this form of financing his purchases.

Leasing? Why is it worth

Financial liquidity

When running a company or managing its finances, you know that there are periods with a larger or smaller surplus on your account. Maybe you even ended a month in minus? You can't look at finances only in the short term. It is longer periods that balance our business revenues and expenses. While large companies with excellent financial results should not be struggling with a lack of cash in their accounts, new or small companies already do. Do you want to create a nice work space for yourself and your employees, but you can not afford to spend all or even part of the surplus accumulated on your account? Because what if it turns out that this month will be worse? A good solution to this situation is payment in installments. You buy now, use it and pay it back in smaller, monthly installments that will not consume all your surplus once.

You have what you want, and by the way you sleep peacefully, that even if you fail to get the planned revenues, previously earned funds are still waiting for your account.

Even if you don't have to worry about the lack of liquidity caused by the lack of cash, after all the surpluses generated should be reinvested in your further development so that your company grows in strength! We're right, right?

Tailor-made repayment system

Think about the amount of free funds you have, commit it as an initial deposit. Break the missing amount into convenient installments that will not overstay your budget. You can also adjust the purchase amount of the assortment. After the contract period, you have two options, either to buy leased products and continue to use them or to exchange them for new ones, financed by subsequent installments.

Possibility of tax deductions

For many entrepreneurs this is a key advantage of leasing. Leasing allows you to deduct a significant portion of your tax costs . Expenses incurred in connection with leasing can be included in tax deductible costs and then deducted from income tax. As a result, the entrepreneur uses a smaller part of the generated profit to purchase. Depending on the form of the leasing, the financial costs also include other expenses related to the purchase, e.g. interest parts of installments, depreciation, initial payment or redemption value . Leasing in this aspect is more beneficial for entrepreneurs who are VAT taxpayers. More on this topic in the previous entry .

Ability to obtain funding

Do you think the bank will grant a loan to an entrepreneur who is just starting his business activity, who has no credit history yet or financial?

Unfortunately, there is a very small chance. Banks or other lending institutions ensure that their creditor is credible. If this is not the case then there are two options. First of all, your loan costs are horrendously high or secondly you just don't get financing. Leasing is a form of financing that you will get even if you are just starting your own business and the costs you incur are largely dependent on how you plan your payments.

Leasing does not affect creditworthiness

Even if you decide to take a bank loan in the future, leasing equipment will not reduce your ability. The bank does not classify leasing obligations as encumbering your credit history.

And do you imagine the situation when you already have one loan, e.g. for office equipment and you intend to take another one? The bank will certainly pay attention to it, and maybe even think that it is "rolling debt", which will significantly reduce your creditworthiness and affect the conditions for the allocation of funding.

What if plans don't turn out to be reality?

This form of financing is very well thought out. Lenders financing businesses that do not yet have a certain position on the market are aware that entrepreneurs may want to terminate the contract during its duration. This is made possible by leasing assignment. What is this? However, if the product range you purchased is unnecessary, you can transfer the rights and obligations to continue the contract to another entrepreneur. How does it look in practice? You no longer need the furniture range that you bought for one of your branches because you decided to close it? Together with the leasing company you are looking for someone who just needs this assortment and pass it along with the continuation of the contract.

Ease and speed of obtaining financing

Have you ever applied for a bank loan? If so, you probably remember how long it took to complete the formalities, complete documents or collect signatures. And yet this time can be spent, for example, on maintaining relationships with customers or contractors. It would certainly be more beneficial for you.

Leasing is a very simple procedure, you choose the necessary assortment, set installments and payment terms, and the rest of the formalities are already done by your account manager.

Check how simple it is:

If you don't find an assortment on the AssetLife website that interests you, nothing is lost.

Contact us, together we will configure such a set and put it on the portal. Then you will be able to get financing for it in the form of installment leasing.

And now it's time for example.

Imagine being an entrepreneur in your company working 16 people + of course you as the person managing the entire crew.

You are planning to buy furniture because the ones in the current office are not very representative anymore and you sometimes hear employees complaining about aching backs after all day sitting at the desk.

Full of enthusiasm you complete your order.

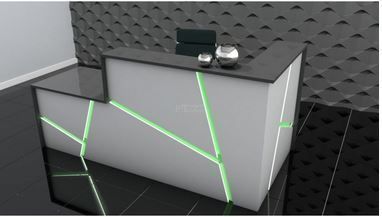

LADA QUATTRO XXL

Lada will be standing in the main entrance and welcoming all customers.

VANCOUVER LITE SOFA and PLAZA 60 TABLE

In the main entrance there must be space for each client. So that he could sit down and have a coffee with us.

NOVEL DESK and TAKTIK MESH ROTARY CHAIR

There are 16 people working in the company, 15 people are office workers

and one receptionist. Each person will receive their own desk and an ergonomic armchair.

Therefore, it needs 15 desks and 16 chairs.

OLIVER F CABINET" S " and OLIVER F "L" WARDROBE

As in any office, filing cabinets are the basis. You order 4 large wardrobes and 4 smaller wardrobes, of course, locked with a lock to protect personal data.

Furniture for the reception and open space for all employees have already been selected, now it's time to choose equipment for the office.

DEMO 2 DESK , CHEST OF DORA C , CONFERENCE TABLE DATA MQ C , HELLO CONFERENCE CHAIR! 4L , ARMCHAIR ARES SOFT

A large and solid desk is the basis. In the office it is also necessary to separate the space for guests.

You made decisions, you chose furniture, but ... .. the calculation you received surprised you a bit. Unfortunately, this is not a positive surprise. You don't want to give up good quality products and save the value of your order. Your customer advisor has offered you a leasing installment payment.

You get the following calculation:

You can choose one of two forms of leasing: operational or financial. You can learn how to do this from the previous entry 3 ways to leasing furniture .

However, importantly, ordered furniture you can already have for PLN 403 net per month!

If you want us to check how the calculation will look for your order, please contact with me.

+ 48 81 884 72 22

Author: Agata Kiraga

Polish

Polish